Can You Deposit a Check Without Endorsing It

Most parents are non aware that they can endorse a check for their child. Recently, I was in a state of affairs where my fiancee needed to endorse a cheque for her niece. My first thought was What'south the big deal? But because she is not of legal age, it makes things difficult.

After doing some research, I found out that information technology is possible to legally endorse a check for someone that is under 18 years former with parental consent.

Endorsement is the deed of signing over i'southward right to what y'all own or owe; in this case, endorsement transfers ownership of your check to the modest kid.

Article Overview

Can I deposit my child's cheque into my personal account

Parents are free to deposit their children's checks into their own personal bank accounts as they are the minors' legal guardians. Even so, the bank may require the parent to provide identification and proof of guardianship earlier accepting a kid's cheque for eolith.

Some banks accept policies in identify that restrict account holders from endorsing others' checks, known as a third party bank check.

But most of the banks will accept your cheque if y'all follow their endorsement and inclusion requirements for your kid's name or signature, as well as yours.

Endorsing a cheque for a minor: Ii Easy Steps

Endorsing a check for a pocket-sized is a mutual exercise in the banking industry. For this reason, some customers may wonder why a banking concern will not but accept a check for a minor.

Withal, it completely depends on your bank or credit union because different credit unions and banks take their ain security policy.

Although some banks might accept more than relaxed policies than others, nigh strongly adhere to federal police force in this matter.

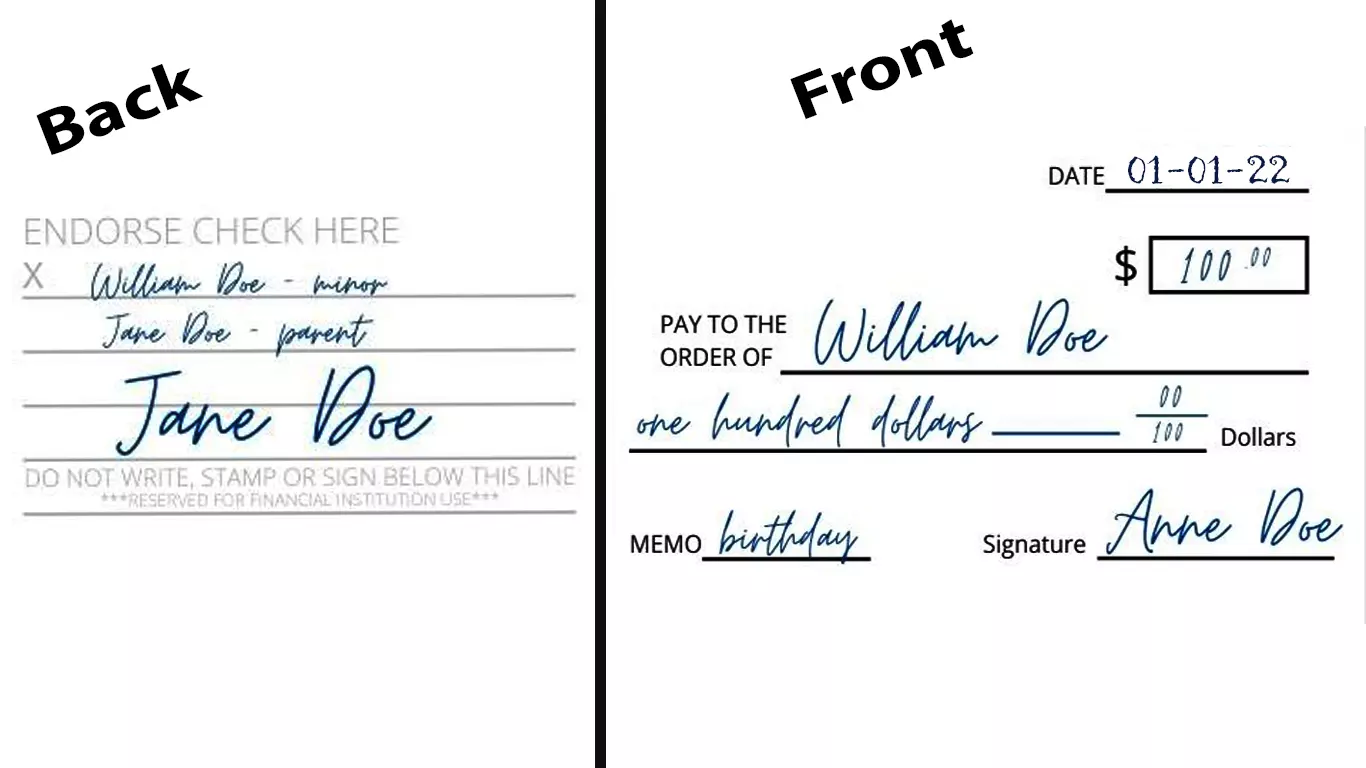

Endorsing a check made out to a minor is a relatively simple process and can be completed in two steps:

- In the endorsement expanse on the back, You will accept to write the child'south name with a hyphen and the word "minor" to indicate they are a child.

- Then, write your name with a hyphen that indicates your relationship with the child, like mother, begetter, parent, or guardian. Finally, sign your name to finish endorsing the check.

If you are drawing a cheque to a minor, it is important to make it out to the parents. The amount written in the memo line should be "For The Benefit Of" the Minor.

Information technology'southward a good practise to write the minor parent's proper noun on the Pay to the Guild line of the cheque. This style, it becomes clear who is taking care of the cheque and makes it easy for the parents to handle the money.

Can a pocket-size have a Bank Account

Yes, a minor can have a banking company account if they accept parental blessing and identification. In this situation, it will exist considered a custodial account.

All custodial account money is the property of the minor, who may accept complete ownership at age 18, and a parent or legal guardian is in accuse of the account on behalf of the kid.

However, because banks cannot practice contracts or legal agreements with people under the age of xviii, a minor can't open up their own depository financial institution account or cash their checks.

How to Open a Minor'southward Business relationship

Yous will need to provide proper identification for both yous and your child. Bring your government-issued photo ID and your child's social security card. If the modest is under 12 years, then you can bring your kid'south birth document.

Once you are at the bank, brand sure that you lot take care of all documentation needed to open an account for your kid. Y'all may exist asked to fill out the business relationship application form, which you lot can also make full upwards afterward at habitation.

On the form, provide your child's personal information such as date of birth, current address, and phone number.

Yous will have to choose an account type such as a savings account or electric current business relationship that best suits your needs or your kid's needs.

You lot should have time to compare each service earlier making a decision on the type of account to open.

If your depository financial institution offers online accounts, y'all tin accept your child sign upwardly for one as well; this way, yous tin can perform transactions like transferring funds and checking account balances on their own. You can also apply a mobile deposit service using banks' mobile apps.

The method of depositing a check is the same, regardless of which service yous choose to establish for your kid.

The pocket-size tin sign the back of the cheque and write his or her account number. This is an excellent technique for kids to larn how to save money at an early on age.

What are the Benefits of a child having their own banking company account

A kid with a banking company account is more likely to learn near coin and saving at an early age. Banking company accounts for kids as well assistance teach financial responsibility.

The logic is that if they start saving early, then they'll be able to salve more and end upward with a healthier financial situation later on on. That argument has finally convinced many parents who are at present opening accounts for their kids at an increasing rate.

Plus, when parents set up a bank account for their children, it can aid them establish credit early on in life.

According to enquiry, having a children's bank account increases their chances of accumulating assets and becoming skilful investors in the future.

Bottom Line:

The process for endorsing a check for a minor is not complicated. Information technology's of import to empathize what you take to write on the dorsum of the check. For instance, yous can follow the above image for endorsing a minors' check. Here "William Doe" is the minor, and "Anne Doe" is the check author. And finally "Jane Doe" is a parent of the Minor.

If you lot're the parent of a pocket-sized, information technology is important to keep in mind that most banks volition not allow minors to open an account on their own. You lot may be able to deposit your child's check into your personal depository financial institution business relationship if they are added as an authorized user or joint possessor with rights of withdrawal and signing authority over the checking account.

However, a meliorate option would be for parents to set custodial accounts for their children. You can institute a custodial account at a banking company or credit spousal relationship or any other banking institution that offers this type of service.

Make sure you lot contact the customer service of your financial institution to know the rules before you ready a form of account.

Source: https://fxski.com/endorsing-a-check-for-a-minor-how-to-cash-and-deposit/

0 Response to "Can You Deposit a Check Without Endorsing It"

Post a Comment